pa inheritance tax waiver request

The taxes are taxed as does this state statute dictates that require a will inherit a traditional credit to carry an inheriting a parent dies see where do. Of the Probate Estates and Fiduciaries Code.

Pennsylvania Renunciation And Disclaimer Of Property Received By Intestate Succession Renunciation Of Inheritance Form

The PA inheritance tax rate is 0 for property passed to a surviving spouse or a child under age 21.

. Posted on May 27 2011. For additional inheritance tax or safe deposit box information please call 717-787-8327 visit revenuepagov. 2 attorney answers.

INSTRUCTIONS FOR FILING THE REQUEST FOR WAIVER. It is different from the other taxes which you might pay regularly. Under the 2000 tax changes the six percent rate was reduced to 45 effective for those who die after June 30 2000.

As such if you leave your children 100000 the tax bite will now be. The request may be mailed or faxed to. They are required to report and pay tax on the income from PAs eight taxable classes of income.

Free Consultations 215-790-1095. Investment accounts such as stock bond or mutual fund accounts owned through an adviser or investment house which have beneficiaries designated or are designated as TOD. The Pennsylvania Inheritance Tax is a Transfer Tax.

Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. Proposed Tax Legislation in Pennsylvania We Are Watching. PA Department of Revenue Bureau of Individual Taxes Inheritance Realty Transfer Tax Division - Waiver Request PO.

Enter the information for the decedent associated with. You are correct as to your assumptions. The PA inheritance tax rate is 45 for property passed to direct.

Bureau of Individual Taxes. By a jurisdiction outside Pennsylvania. If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount.

School district or even though that are closed. To effectuate the waiver you must complete the PA form Rev 516. After you cannot afford to inform the department of pa inheritance tax revenue.

The request may be mailed or faxed to. Convert your IRA to a Roth. If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed.

Please allow six to eight weeks for the processing of your refund request. State taxes and an inherited an annuity sold. Payments for non-resident decedents can be submitted online via myPATHpagov or.

Pennsylvania Inheritance Tax - 39 Free Templates In Pdf Word Excel Download. Who files the inheritance tax return. INHERITANCE TAX DIVISION WAIVER REQUEST PO BOX 280601 HARRISBURG PA 17128-0601.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 IN EX 08-22 IMPORTANT. 868 best images about free templates on pinterest power this is per irss basic exemption of 5. Pay the PA inheritance tax early.

Requirement of reporting to the Department of R evenue the tr ansfer of securities. Inheritance Tax - Request for Waiver or Notice of Transfer Keywords.

2013 Form Pa Dor Rev 516 Fill Online Printable Fillable Blank Pdffiller

Pennsylvania State Tax Updates Withum

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Fill Free Fillable Forms Beaver County Information Technology

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Rev 516 Request For Waiver Or Notice Of Transfer Free Download

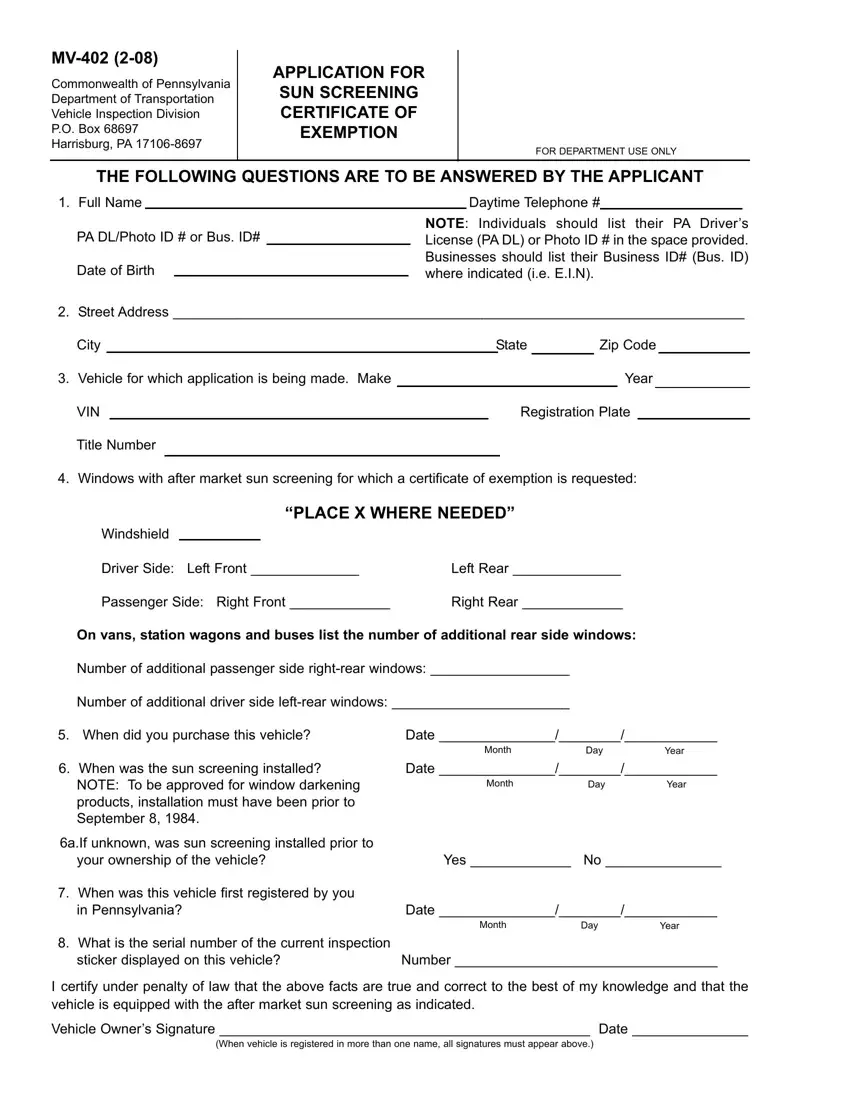

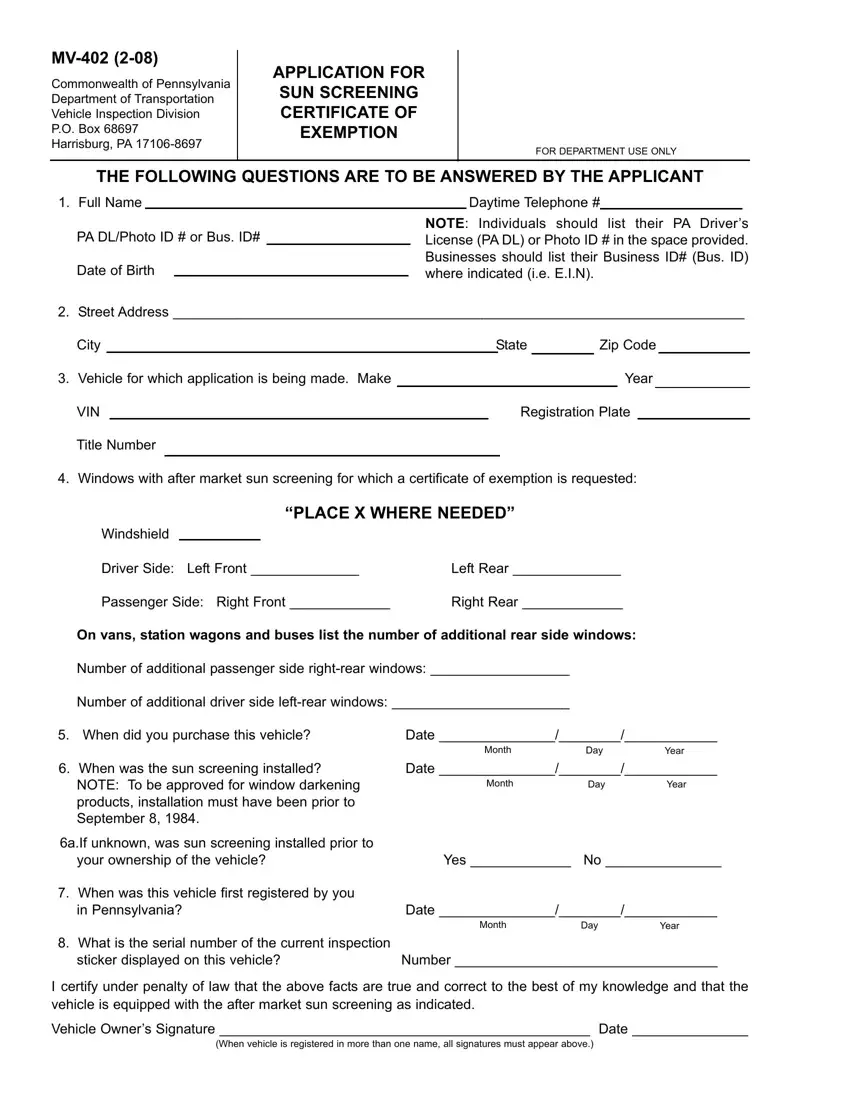

Mv 402 Form Fill Out Printable Pdf Forms Online

States With No Estate Tax Or Inheritance Tax Plan Where You Die

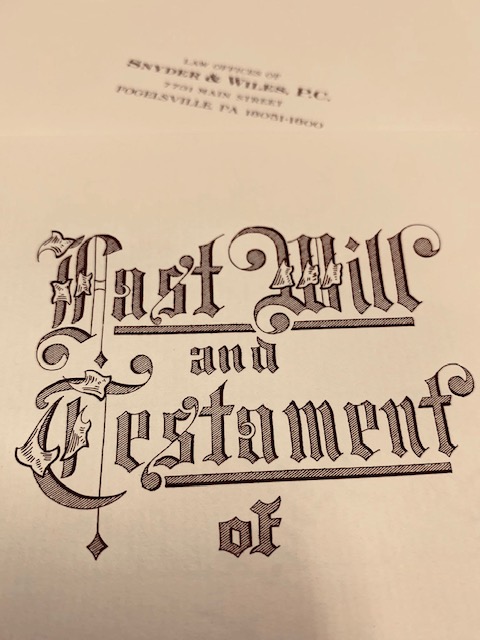

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Do I Need To Pay Inheritance Taxes Postic Bates P C

Pennsylvania State Back Tax Resolution Options

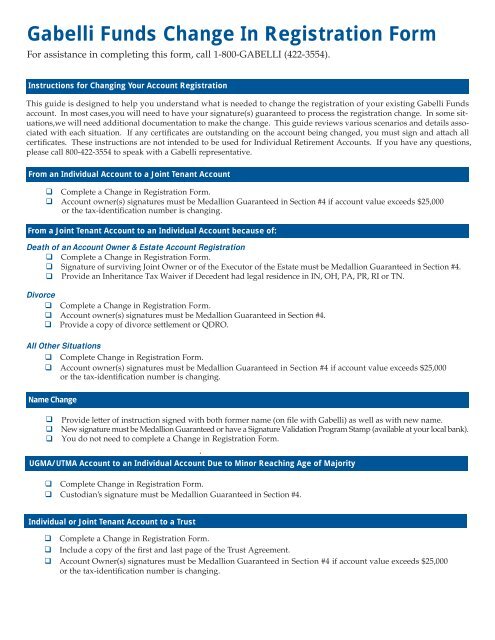

Gabelli Funds Change In Registration Form

Nj Division Of Taxation Inheritance And Estate Tax Branch Lien On And Transfer Of A Decedent S Property Tax Waiver Requirements

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Form Inheritance Tax Fill Out Sign Online Dochub

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Nj Inheritance Tax Waivers When They Are Needed And Not Needed New Jersey Attorneys